Account payable automation software automates the entire procure-to-pay process. It helps in accelerating payments while cutting down the costs and lets your employees focus more on core areas of business. Accessible from mobile and desktop. All the employees and the organizational hierarchy can go through the invoices, orders, etc at any time. This software automates the process of receiving invoices to paying the suppliers directly to their bank accounts without much manual work.

Are you Tired of

- Manual data entry

- Paper processes

- Unorganized invoices

- Inefficient and time taking work

- Human errors

- Missing paperwork

- High payment processing costs

- Missing out on important areas

- Piles of dusty and paper invoices and documents

- Lack of visibility of cash flow

Key Points

- Cut down costs

- Increase productivity and accuracy

- Attention to core areas

- Budget control

- All invoices organized in a queue

- Reports of all the purchases

- Integrate with ERP

- Maintains workflow

- No possibilities of fraud cases

- Visibility of cash flow and No cash leakage

- Low payment processing cost

- All invoices can be digitally stored

- Manage large volumes of invoices

An Account payable automation software

- Saves time and energy

- Reduces wasting of papers and ink

- Transparency throughout the process

- Saves money by cutting payment processing costs

- Error-free Procure to pay process

Procure to Pay Solution

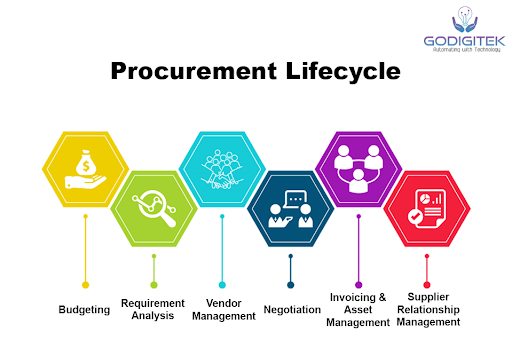

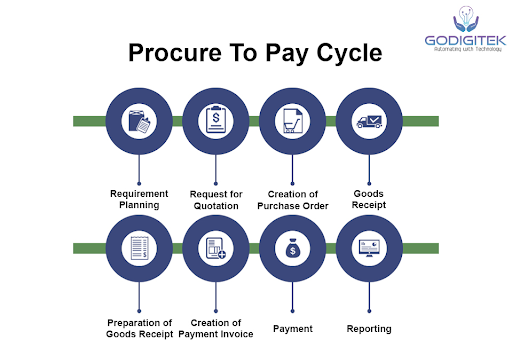

Procure to pay process includes all the steps right from requisition to payment to the supplier. The traditional process contains six steps

- Requisition

If anyone in the business wants to get some goods and services for the company, they make a purchase requisition at the department level. Traditionally, it is done by mail with some spreadsheets and quotes attached.

2.Approval

Your requisition needs approval from the organizational hierarchy. When done manually can be a cumbersome process as you need to chase them for approval.

3.Purchase order

Once your requisition is approved, the next step is to issue a purchase order. Traditionally it is done by issuing the purchasing order papers to suppliers via email by attaching the documents. All purchase orders are manually placed manually via excel sheets and keep track of it.

4.Receipt

A GRN and SRN manual receipt is generated by a supplier. It is difficult for employees at every level to check on individual and multiple receipts whether they are received or not.

5. Invoice

After the goods and services are received, the supplier submits an invoice for the payment of the goods. It is submitted via mail, fax, etc. Traditionally you have to get it approved by the organizational hierarchy.

6. Payment

After the invoice is reconciled and approved the next step is payment to the supplier. It is generally done using paper checks or via net banking. Once payment is made to the supplier it is reconciled and pushed manually to ERP.

Challenges faced in the traditional system

- Manual data entry

- Loss of productivity

- All the approval done on emails and there is no track of purchase

- Time-consuming

- Prone Human errors

- Lack of visibility on the procurement life cycle of the goods and services.

Key Points

- Increased productivity

- All the information well organized

- Time-saving and Smooth processing from start to end of the procurement lifecycle

- Reduced Procurement cost

- Accessible by the employees and all the organizational hierarchy

- Approvals over the web-based and mobile-based application

- Reporting analytics of the entire spent management of the company.

- Increased cash flow visibility

Direct Invoice to Pay Solution

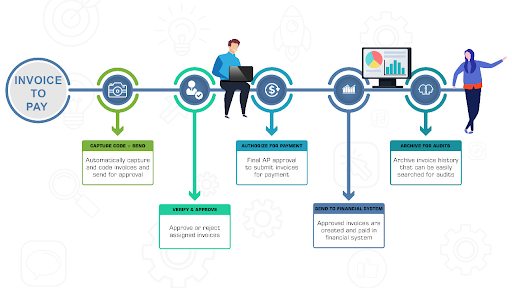

The invoice to pay process includes the steps of receiving the invoice the payment to the supplier.The steps are

- Invoice

After the goods and services are received, the supplier submits an invoice for the payment of the goods. It is submitted via mail, fax, etc. Traditionally you have to get it approved by the organizational hierarchy.

2. Payment

After the invoice is reconciled and approved the next step is payment to the supplier. It is generally done using paper checks or via net banking. Once payment is made to the supplier it is reconciled and pushed manually to ERP.

Challenges faced in the traditional system

- Manual data entry

- Loss of productivity

- All the approval done on emails and there is no track of purchase

- Time-consuming

- Prone Human errors

- Lack of visibility on the procurement life cycle of the goods and services

Key Points

- Increased productivity

- All the information well organized

- Time-saving and Smooth processing from start to end of the procurement lifecycle

- Reduced Procurement cost

- Accessible by the employees and all the organizational hierarchy

- Approvals over the web-based and mobile-based application

- Reporting analytics of the entire spent management of the company.

- Increased cash flow visibility

Automated Invoice Process

- Invoice

Invoice can be sent digitally by the supplier via the software. Using automated software makes invoice reconciliation easier and faster. Approval of invoices can be done via a mobile app or web application.

2. Payment

After the invoice has been approved the payment is directly sent to the bank account of the supplier. The invoice is directly pushed into the ERP reducing the manual entries by the finance department.